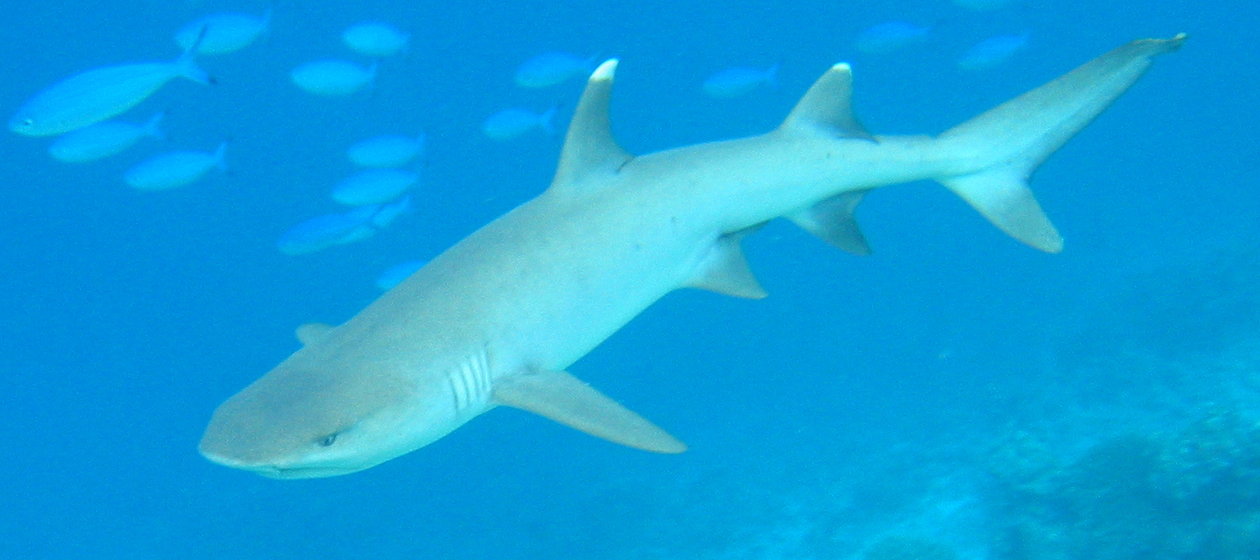

Loans Outside of APEX; Sharks or Saviors?

The Centralized Load Provision Service (CLPS for short) has opened its doors publicly to both financiers and borrowers.

TheReif reached out to company owners trying to help build up interest in CLPS:

Are you [a CEO] with lots of money and nothing to do? If yes we have a solution for you, invest your money in [companies] that are expanding, invest in Centralized Loan Provision Service (CLPS). Are you a [CEO] with lots of lucrative business ideas but that doesn’t have the resources? If yes we also have a solution for you. Get a loan with low rates a CLPS before the money runs out. Message me for more information.

Prosperous Turnip prides ourselves on digging deeper. So we found some knowledgeable people to talk about CLPS’s loan policies.

Pete Chargz, lead collector for Vallis Vincente Loans had this to share:

It’s a foolish operation. You don’t want to borrow money from investors if you don’t have to. You lend it out, make sure your rates are high enough, get it returned, or start breaking kneecaps to make them return it. Rinse. Repeat.

Grober Habel, CEO with a broken knee, shared his story too.

I had my options, and even considered CLPS as a sponsor. In all my research, they had such a horrible rap of beating the borrowers that I couldn’t fathom the idea of being mauled before I could afford to repay the loan. I guess it didn’t matter much, I still ended up with a broken knee.

CLPS wouldn’t respond to the accusations without being formal about it. But that wouldn’t capture the attention of our readers.